Kenya’s National Social Security Fund (NSSF) has introduced new contribution rates for 2024, marking the second year of implementation under the NSSF Act Cap45 of 2013.

Understanding Tier I Deductions:

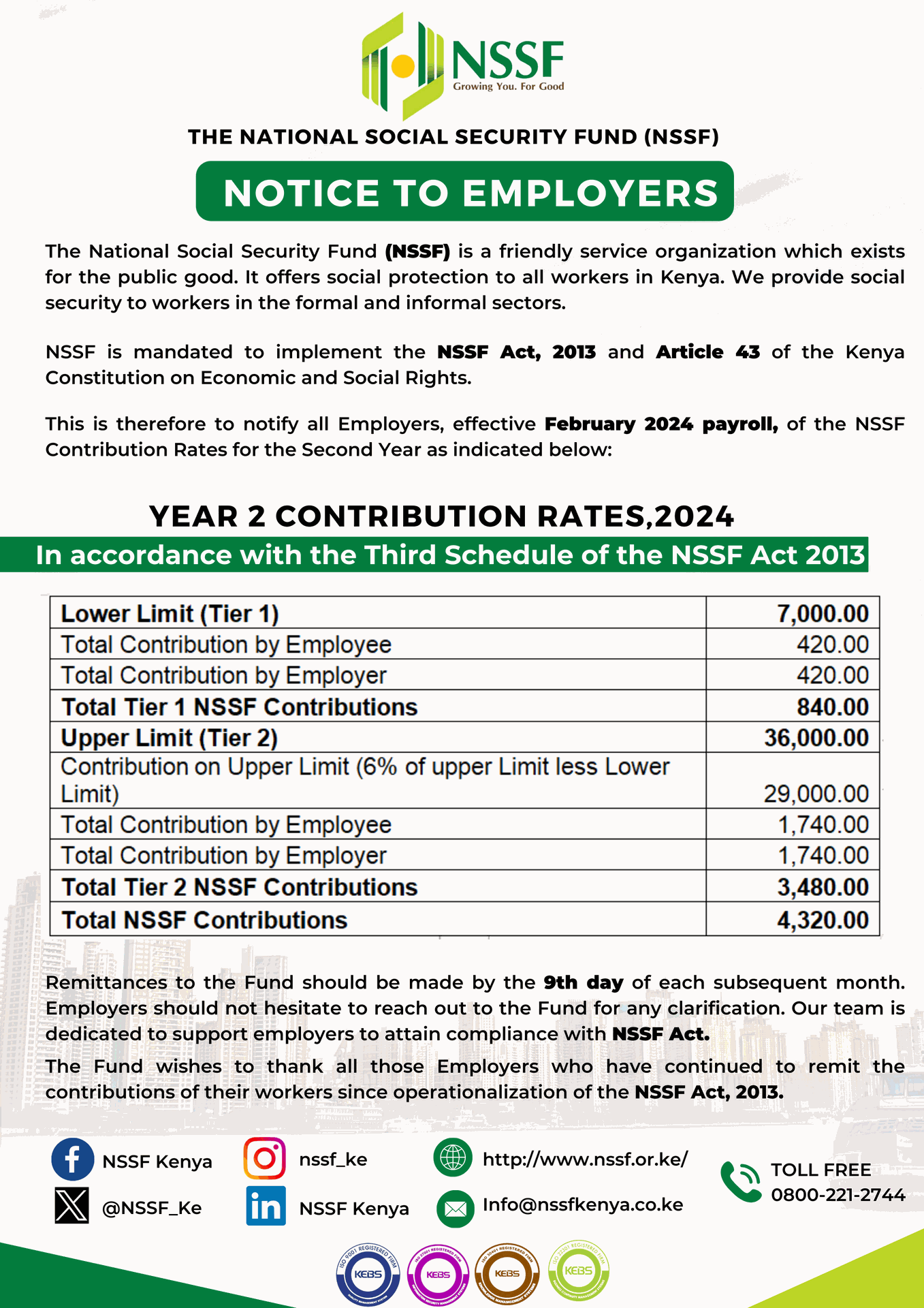

The revised lower limit of Ksh 7,000, up from Ksh 6,000, has implications for Tier I deductions. Employees falling under this category will now contribute Ksh 420, a notable increase from the previous Ksh 360. Employers will match this amount, ensuring a balanced contribution structure.

Exploring Tier II Deductions:

Tier II deductions have seen a significant shift with the revised upper limit now set at 1x of the national average wage, up from the previous 0.5x. This adjustment doubles the deduction from Ksh 720 to Ksh 1,740. Employers will match this amount, creating a substantial impact on overall contributions.

Total NSSF Contributions:

Effectively, starting February 9th, 2024, total NSSF contributions undergo a considerable change. The total contributions now increase from Ksh 2,160 (Ksh 720 + Ksh 1,080) to Ksh 4,320 (Ksh s 840 + Ksh 3,440). This alteration reflects a significant adjustment in the financial commitments of both employees and employers towards social security benefits.

Conclusion:

As Kenya’s NSSF enters the second year of implementing the NSSF Act 2013, these new rates reshape the contribution landscape. Employers and employees alike must adapt to these changes, ensuring compliance for financial planning and social security benefits. Stay informed, navigate the new rates, and secure your financial future.

Stay updated

Tax Changes - Nssf Changes Effective Feb 2024